Recently, I attended the ARC Advisory Forum in Orlando, Florida. I found it to be is very reassuring that the vision and mission we are addressing with Uptake Fusion as an Industrial Data Analytics Hub is well recognized in the Energy and Manufacturing market.

Our client Phillips 66, was able to present in the “Future Is Now: It’s All About the Data and User Experience” facilitated by Janice Abel from ARC. Abel began by sharing a few graphics highlighting the need to change how we approach Industrial Data and Analytics.

Abel stated that 85% of the installed base of data historians and data platforms were on-premise systems in 2021. However, that cloud technology will be the fastest moving in the next five years. We see this firsthand across the industries we serve – Oil & Gas, Refining, Chemicals, Power Generation, Pulp & Paper, Textile, and Water Wastewater, as portrayed by the graphic below from ARC:

According to the IDC article – IDC Future of Operations Survey data, the potential for cloud technologies to break down silos and enable more contextualized views of data is dramatically impacting enterprise investment priorities for operations.

“A point of resistance just a few years ago, organizations are now prioritizing investments and building strategies for putting operational data into the cloud,” said Leif Eriksen, Research Vice President of Future of Operations. “And, while the momentum is irrefutable, organizations will need to develop a specific cloud data management strategy that addresses organizational needs and objectives.”

The Challenge

To contrast this with some of our findings is depicted in the graphic below.

Despite the efforts in the last 20+ years provided by data historians and other traditional data platforms (white boxes in the graphic above), we still see Operational Technologies (OT) data being locked in silos and inaccessible to the broader audience. As well as found that a small percentage of this data is used in meaningful activities. These challenges are becoming more prominent as analytics prioritizes our clients’ digital transformation strategies.

Furthermore, based on the state of data science report published by Anaconda, we still see that about 45% of the data science and analyst time is spent getting data ready (loading and cleansing). The graphic above highlights the need for a step change to help us bridge existing gaps and prepare us for more sophisticated analytics with higher data fidelity and complexities.

Many traditional historian suppliers have been acquired by large automation conglomerates. They have shifted their direction towards SaaS-based offerings and cloud/edge-based analytics with new requirements. Most of them are no longer agnostic nor implemented on clients’ cloud environments, which reduces companies’ ability to freely monetize their data with their value chain and supply chain.

As depicted by the graphic below, digital transformation journeys will require organizations to define a vision and goals so they can associate opportunities and use cases with business value. Based on our experience, every department and function will have different use cases that impact different personas’ decision-making and workflow interactions. As found by our client Phillips 66, the systems involved in supporting many of those use cases are mostly the same, with slightly different data volume, latency, aggregation, and granularity datasets requirements.

As Janice Abel shared, industrial data’s complexity is continuously expanding from structure process data to multi-dimensional, unstructured, geospatial, and 3D. There is not one single supplier that can do it all.

The Solution

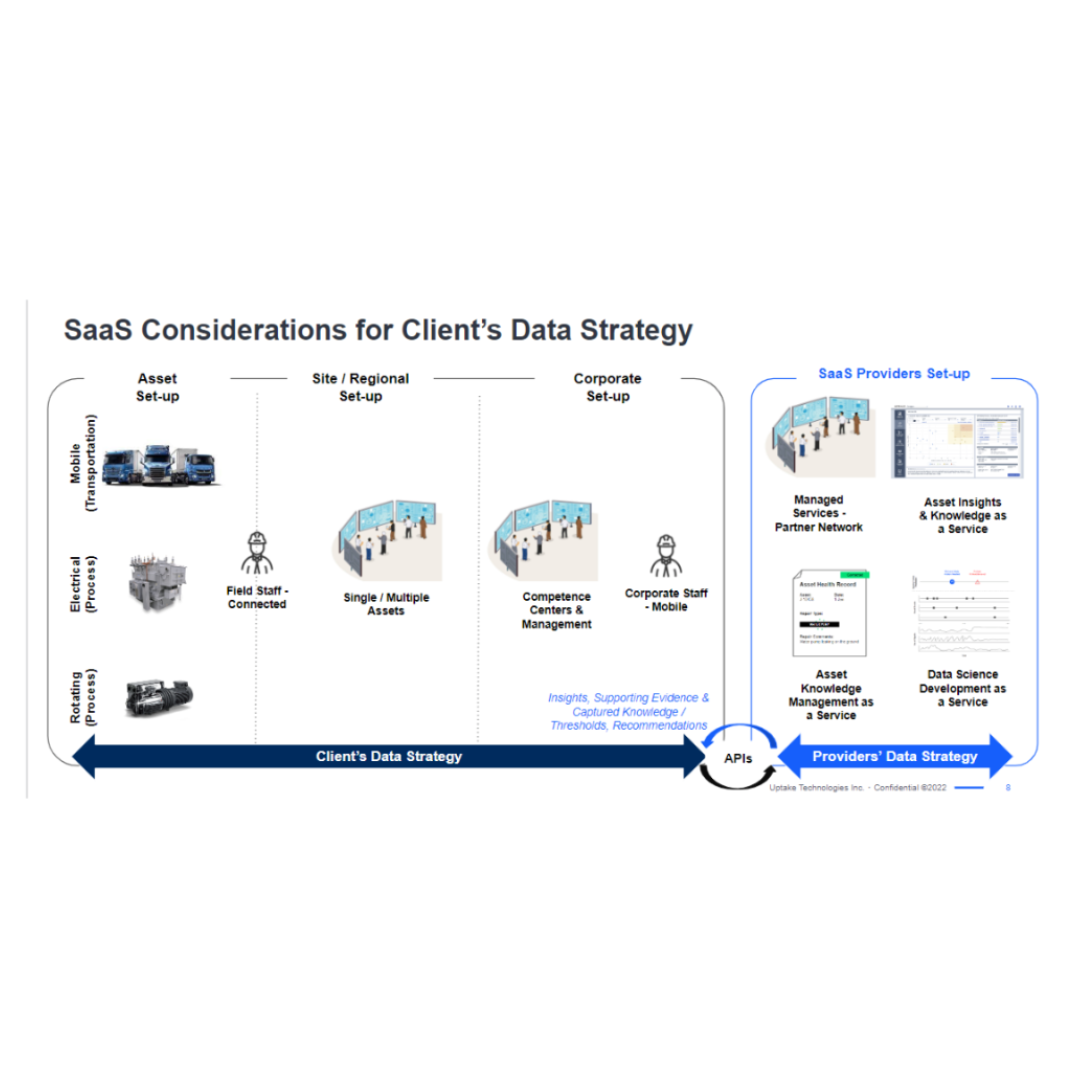

In order to address the variety of use cases, this is an ecosystem play. Operating companies need to conclude that they will get exposed to various suppliers who will want to collect data from the field, and operational systems and deliver insights into what they are good at. These operating companies will also be exposed to a variety of SaaS-based applications that need access to the same data as others.

Yet, these operating companies also need to realize that they need to serve the needs of their internal organizational sites, departments, and functions. Each of those organizational levels may define a different application strategy, they may decide to build their own applications to fit their business processes (KPIs, dashboards, reports, analysis, workflows), or they may go with more standard supplier-provided pre-packaged SaaS application offerings.

In order to prepare for the future, although it may seem uncertain, it is imperative to establish your data strategy first, gain control over your data and then decide who/how data will be shared and accessed by different parties in your value and supply chains. A B2B or B2C partnership with a SaaS Provider and/or a client is great consideration but keep in mind that this is not a one size fits all approach, so you are mostly going to need commercial partnerships with multiple suppliers (OEMs, Service Providers, Analytics application providers), especially with those suppliers who offer pre-packaged SaaS solutions. This will help accelerate the time to value while reducing the Total Cost of Ownership (TCO)s.

To put this into context, one of our Uptake clients established a commercial agreement with a SaaS Pipeline Integrity application rather than developing a completely new set of capabilities on their own. Uptake Fusion was able to share a large aggregated dataset residing on our client’s cloud environment to deliver 2+ years worth of granular data of our client’s pipeline network segments to the SaaS Pipeline Integrity provider, OneSoft OneBridge – read more.

With this approach, our Fusion client has established a much more flexible method to share data with internal and external parties. Some, such as Onebridge, may require larger aggregated data sets, but others will require more granularity, especially as we see more analytics applications moving to the edge towards driving more automation at the equipment and process level or semi-autonomous requirements with operator guidance applications and in the future fully autonomous and self-adaptive systems. Another similar use case example relates to Fracking Monitoring Activities – learn more.

The Value

In summary, its crucial operating companies establish their own data strategy first.

- Protect your critical on-premise operational systems both from a cyber-security and performance usability perspectives for what they were initially designed for.

- Leverage the advantages of the cloud and the ecosystem of IoT and analytic providers to accelerate time to value for acquiring new data.

- Centralize all the data in an environment where you have control and can make decisions about who gets access and what to share. The opportunity to monetize that data is too high of a price to just give that responsibility away to a third party to host and manage that value delivery.

- Assemble your data strategy with out-of-the-box components that will help accelerate your overall vision. For example, Uptake Fusion, as an Industrial Data Analytics Hub, provides acceleration and alignment with your data strategy in Microsoft Azure. We leverage core Azure Resources, and we store the data in non-proprietary Azure resources, so your data is always safe and accessible to you. Uptake Fusion aligns with your DataOps lifecycle, so you gain control over your industrial data at a granularity level that will allow you to support the data requirements for current and future analytics applications.

By doing so, you gain from a flexible model that will allow you to support the various use cases; some may be better with an internal development strategy that drives Intellectual Property(IP) differentiation, but others may be accelerated with commercial off-the-shelf SaaS applications. As depicted by the picture below, that is the great value cloud offers which includes enabling new ways to operate and establish new and better business models with suppliers and/or customers.

As per the image above, are you ready to get fit and stretch the value of your Industrial data? Start with Fusion, an industrial data analytics hub that helps you gain control over your industrial data so you can have the flexibility to accelerate your analytics initiatives and decide how to best maximize its monetization as part of your overall data strategy from your own cloud.

Thank you for your time. We will share more market needs and how Fusion supports those needs.